How to Safeguard Financial Meeting Security? Kuailu's Private Deployment with Four Lines of Defense: Meeting Both Regulatory & Confidentiality Standards

In Financial Institutions: How Kuailu Meeting Fortifies Security for Confidential Discussions

In financial institutions, a credit approval meeting may involve tens of millions of customers' credit reference data, while an investment banking project seminar could determine the success or failure of an IPO. Once information is leaked, it not only leads to huge fines and the collapse of customer trust, but also becomes a crisis for the company's lifeline.

Targeting the "highly sensitive and highly compliant" characteristics of the financial industry, Kuailu Meeting builds four major security lines of defense—from data transmission to hardware isolation—based on private deployment. Today, we reveal for the first time how it constructs a solid security fortress for financial institutions' meetings.

I. End-to-End AES256 Encryption: The "Bulletproof Vest" for Data Transmission

Voice, documents, decision-making content... These are most vulnerable to attacks during transmission. Kuailu adopts bank-level AES256 encryption technology, equipping data with an "invisible bulletproof vest":

- Full-process Encryption for Seamless Protection: From speech to presentation, data is transmitted in ciphertext form across all nodes such as servers and routers. Interceptors will only see a string of garbled characters.

- Dynamic Keys with Automatic Rotation: Encryption keys are rotated regularly to avoid cracking risks caused by long-term use of the same key.

- Intuitive Security Dashboard: Administrators can real-time check the encryption score and key update status, easily grasping the meeting security level.

II. Confidential Meeting Mode: A "Security Restricted Area" Even Administrators Can’t Access

Internal privilege abuse is a hidden bomb—in traditional systems, IT administrators can access all meeting content. Kuailu directly plugs this loophole through its confidential meeting mode:

- Precise Pre-Meeting Access Control: Only the meeting initiator can invite participants, and joining the meeting requires dual biometric authentication (facial + voiceprint).

- Invisible In-Meeting Content: Meeting recordings and documents are stored in encrypted partitions. IT administrators can only view basic meeting information, not the specific content.

- Traceable Post-Meeting Operations: Secondary verification is required for minutes download, and all operations generate audit logs, forming a complete traceability chain.

III. Hardware-Level Data Isolation: Dual "Moats" (Physical + Logical)

To meet the "data localization" requirements of financial supervision, Kuailu achieves strict isolation through two layers: physical and logical:

- Physical Isolation from Public Network: The system is deployed in the institution’s on-premises computer room or private cloud, realizing physical isolation from the public network. Equipped with encrypted hard drives, data cannot be read even if the hardware is stolen.

- Logical Privilege and Domain Separation: Through virtualization technology, independent meeting spaces are set up for departments such as credit, investment banking, and risk control. Data does not flow between spaces, and keys are managed independently.

- ✅ Solution Value: The person in charge of the Technology Department of a city commercial bank stated: "It not only meets the regulatory requirements for data localization, but also prevents cross-leakage of different business data within the bank."

IV. Real Cases: From Regulatory Rectification to Security Benchmark

Case 1: A City Commercial Bank – Completed Compliance Rectification in 30 Days, with Approval Efficiency Increased by 40%

- Original Pain Point: Meeting data was stored in the public cloud, which did not meet regulatory requirements, leading to a rectification notice.

- Kuailu Solution: Private deployment + confidential meetings + full-process auditing.

- Outcome: Not only passed regulatory acceptance, but also significantly improved the efficiency of credit meetings.

Case 2: Zero Leakage in IPO Projects, Becoming an Industry Security Model

- Original Risk: Review materials were prone to leakage, posing the risk of being held accountable by the Securities Regulatory Commission.

- Kuailu Solution: Triple authentication for meeting access + digital watermarking + hardware isolation.

- Outcome: No leakage occurred in key projects throughout the year, and all compliance inspections passed on the first try.

Conclusion: Meeting Security Is Not Just a "Feature Option" – It’s the Lifeline of Financial Institutions

In the wave of digital transformation, many institutions focus on efficiency but neglect security. However, once security is breached, even the most powerful functions become meaningless. Kuailu’s four major security lines of defense accurately meet the core needs of the financial industry:

- End-to-end encryption – Prevents transmission interception

- Confidential meeting mode – Prevents internal overreach

- Hardware-level isolation – Prevents physical breaches

- Compliance-oriented design – Prevents regulatory risks

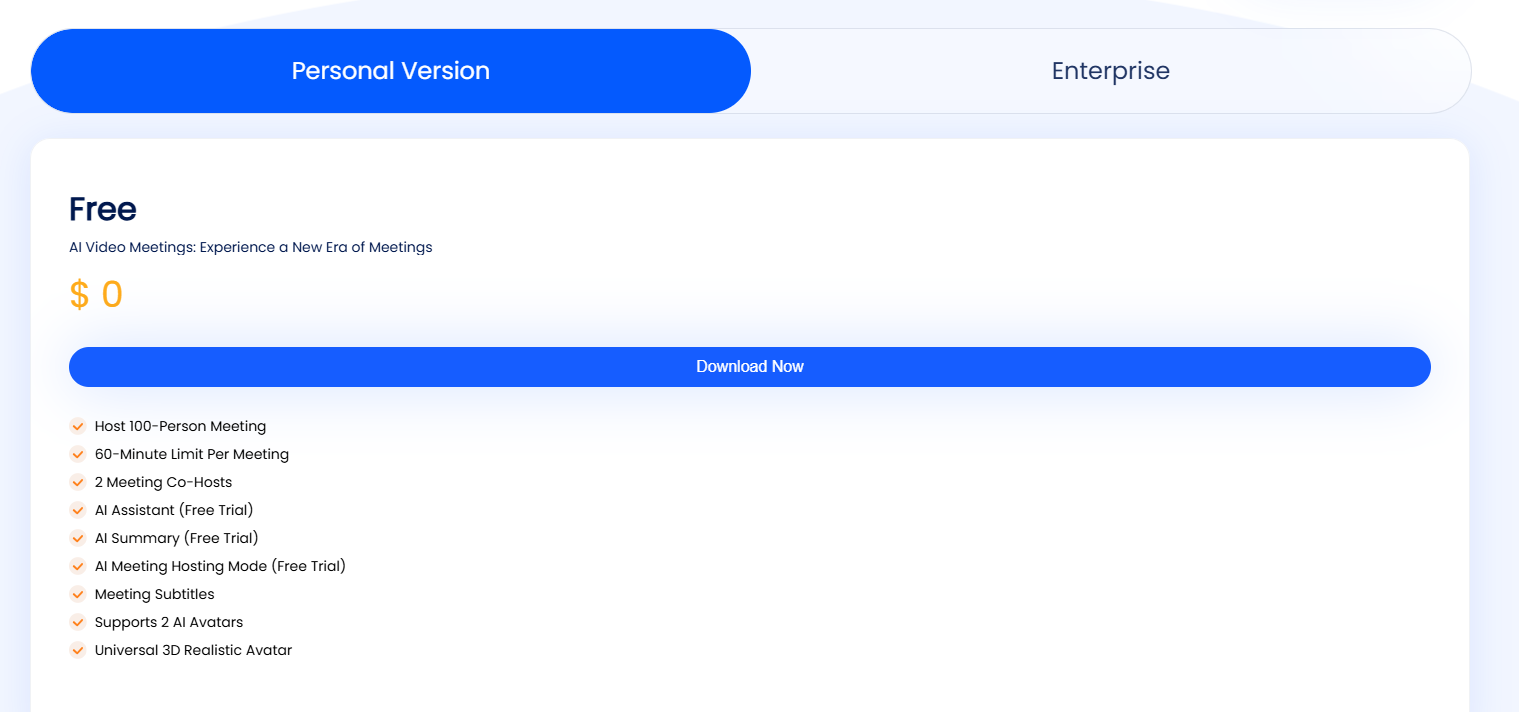

Take Action Now: Enhance the Security of Your Meeting System

Kuailu has now opened an exclusive financial demonstration channel. Click to make an appointment to watch real technical demonstrations and apply for a 30-day free trial of all features. Fortify the bottom line of meeting security and ensure every confidential discussion is truly worry-free!